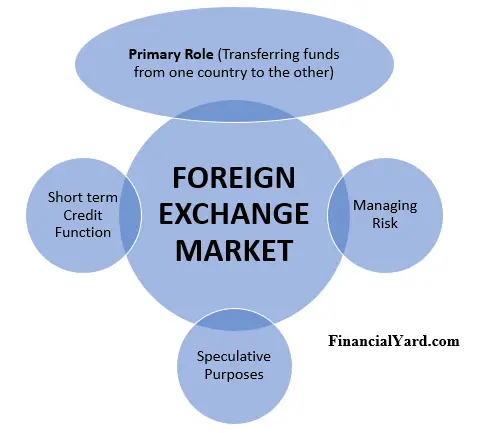

Also known as the forex market, the foreign exchange market is where currencies of different countries are bought and sold. This article outlines the functions of the foreign exchange market. In order for the forex market to function there needs to be demand for and supply of foreign currency. The foreign exchange market is comprised of 4 markets namely, a spot market, forward market, options market and the derivatives market. The foreign exchange markets’ major functions are outlined as follows.

Table Of Contents

The Primary Role: Transfer Function

The primary function of the foreign exchange market is the transfer of funds from one country to the other. It facilitates the conversion of one currency into another. This accomplishes the transfer of purchasing power between two different countries. This is the primary function of the foreign exchange market. The funds can be transferred through telegraphic transfers, bills of exchange, foreign bills and bank drafts. The foreign exchange market determines the price of one country’s currency relative to another country’s currency.

Capital flows, receipts and payments for imports and exports determine the exchange rate. Under the gold standard before 1972, currencies were fixed against the United States dollar. This meant that the exchange rate was not determined by supply and demand on the foreign exchange market. When governments of the largest economies in the world decided to let their currencies fluctuate freely the role of the foreign exchange market became much more important. Thus the major function of the foreign exchange market is the transfer function.

Floating currency

If a currency is free to respond to supply and demand it is said to be a free-floating currency.

Managed float

If central banks intervene in the market by making purchases and sales of forex in order to keep the currency within a specified band then the currency is said to be managed.

Pegged Currency

If the exchange rate of a local currency is fixed by decree it is said to be pegged.

Short Term Credit Function

Another major function of the foreign exchange market is that of provision of short term credit. The foreign exchange market provides short term credit to importers so that goods and services from one country to another can flow with ease. An importer can finance his/her imports on credit by issuing a bill of exchange in the foreign exchange market. This is an essential function of the foreign exchange market.

Managing Foreign Exchange Risk

Managing foreign exchange risk is an important function of the foreign exchange market. Due to the fluctuating exchange rates in the foreign exchange market there is need for hedging. The parties in the market hedge foreign exchange risk by participating in the forward market. In the forward market one buys a forward currency contract with a currency pair for a pre-determined amount, rate and date. This is agreed upon on the time of dealing. The rate quoted on the forward market is called a forward exchange rate. If a British company imports goods from the USA and agrees to settle the payment in 3 months’ time from the day of purchase the company can buy US dollars now on the forward market and agree on an exchange rate (the forward rate). The company can buy US dollars today at the agreed upon rate and pay the supplier in 3 months’ time. That way, the risk that the British Pound will depreciate relative to the US dollar will be avoided by fixing the exchange rate in advance. This example illustrates the risk management function of the foreign exchange market.

Speculation Function

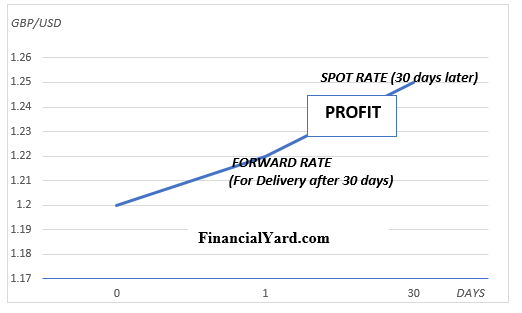

Speculation is a popular function of the foreign exchange market. Speculators can purchase foreign currency for future delivery if they believe that the spot rate (the rate at which one buys or sells a currency for settlement within 2 working days) for a future date will be higher than the current forward rate. If the current spot rate for British pounds and the US dollar currently stands at US $1.20 = £1.00 and the forward rate on the forward market (30 days delivery) stands at US $1.22 = £1.00. An American speculator can anticipate a depreciation of the US dollar on the spot market, after 30 days, to US $1.25 = £1.00. S/he will purchase the British pounds on the forward market so that after 30 days s/he pays US $1.22 for £1.00 and not US $1.25. S/he can then quickly sell the British pounds for US $1.25 each and enjoy a profit of US $0.03 (US $1.22 – $1.25) for every pound. Te above example clearly shows the speculative function of the foreign exchange market.

The Players

Central Banks

Central banks play a crucial role in the foreign exchange market. They assist the government in implementing their economic policy. The reserve bank also plays a role in protecting the value of a local currency especially in countries with a managed exchange rate or a pegged exchange rate. In such cases the central bank will intervene by buying and selling foreign currency in the forex market. However, intervention by central banks is perceived in a negative light and may worsen a depreciating currency. Central banks monitor the transfer function of the foreign exchange market.

Authorised Banks

Authorised dealer banks are one of the major players in the forex market. Authorised dealer banks are market makers since they quote buying and selling rates in the forex spot and forward markets. Banks facilitates the transfer, speculation, risk management and short term credit functions of the foreign exchange market.

Exporters and Importers

Firms that buy and sell supplies from different countries must pay suppliers and workers in the local currency of the country in which they operate. These companies also receive payments from many customers in many different countries. their foreign currency earnings are converted to their home currency. McDonalds, KFC and Mercedes are among some of the international companies. Exporters and importers depend on the transfer function of the foreign exchange market.

Investors

Individuals and companies invest in assets such as shares, bonds and property in other countries. In order to pay for their investments, they need to convert their home currency into foreign currency in order to invest in another country. Also, the returns from the foreign direct investment need to be converted to their home currency. Foreign investors utilize the transfer function of the forex market.

Speculators

Speculators can be banks, professionals and individuals from the household sector. A Speculator buys and sells foreign currency for profit. Foreign currency is traded like a commodity. Sometimes the speculators are blamed for the volatility of currencies since they can attack a weak currency by selling it off and further depreciate it or buy a strong currency increasing demand for it so that it becomes overvalued. A large number of speculators in the world have more money at their disposal than most countries’ annual budgets. Speculators utilize the speculation function of the foreign exchange market.

The Major Currencies In The World

Highly Industrialised economies in the world have strong currencies. These are the Group 8 nations, USA, Germany, Japan, the UK, Canada, France, Italy and Russia. However, the Euro has replaced a number of major currencies such as the Deutsche Mark and the French franc. From a trading point of view the US dollar is the dominant currency. Overtime the importance of currencies will vary but the US dollar ($), UK Pound Sterling (£), Euro (€) and the Japanese Yen (¥) could arguably be rated as the major currencies.

Key Words

BILL OF EXCHANGE

A written, unconditional order by one party to another to pay a certain sum either immediately or on a fixed date.

HEDGING

Investment positions intended to offset potential losses that may be incurred.

FORWARD MARKET

A market where one buys or sells a specific currency pair for a predetermined amount, rate and date which are agreed upon at the time of dealing.

SPOT MARKET

A market where one buys or sells a currency for settlement or delivery within 2 working days.

FOREIGN DIRECT INVESTMENT

When companies or individuals invest in assets in foreign countries.