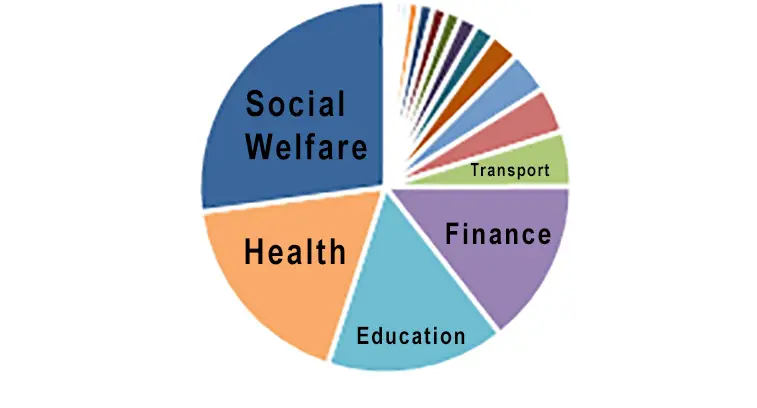

There are two major parts in public finance: revenue and government expenditure. Government expenditure is normally used to raise the aggregate demand in a country, improve income distribution, ensure economic stability as well as accelerating economic growth. Government expenditure can be classified into various categories with the major one being, current expenditure, capital expenditure and transfer payments. The classification of government expenditure differs in each country, but the contents are the same. Also, the classification on public expenditure rests on what the spending promotes or what the objectives of the spending are.

Table Of Contents

What is Government Expenditure

Government expenditure refers to the purchase of goods and services by the government in addition to investment spending. Government expenditure can be regarded as a continuous bureaucratic process where governments decide the activities and spending that should be done by the government in order to boost a country’s economy.

Current Expenditure

Current expenditure is a classification of government expenditure. It is expenditure on goods and services for current use, to satisfy individual or collective needs of the members of society. Current expenditure includes civil administration, wages, salaries, goods and services that the government pays out on a regular basis.

Wages and Salaries

Wages and salaries fall under the current expenditure classification of government expenditure. The government pays wages and salaries to its employees such as soldiers, the police service, educators employed in public schools as well as health workers including doctors and nurses, to name a few. The wage bill is normally the biggest compared to other expenses incurred by the government. Since the government is the largest singe employer, its employment and wage policy directly affect the labour market.

Goods and Services

Under the classification of government expenditure there are payments of goods and services included in current expenditure. This includes all the goods and services bought by the government. Such goods may be for consumption or for use in the production of fixed capital assets. For example, the purchase of schoolbooks, blackboards and stationery including other relevant equipment. Goods and services also include spending on university research centres and hospital equipment and also regular maintenance of public government institutions. Other maintenance expenditure include removing potholes in roads and the servicing of public transportation.

Transfer Payments

Transfer payments are another classification of government spending. In some countries transfer payments are included under current expenditure. Such expenditure does not involve buying goods or services. Instead, this type of spending represents the transfer of money such as social security payments, pensions and unemployment benefits. These transfer payments comprise of payments to other levels of government, non-profit institutions and households in order to add onto their disposable income.

Subsidies

Subsidies are another classification of government expenditure, sometimes they are classified together with transfer payments. Subsidies are designed to influence the level of production of certain goods or services. They are given to specific companies or industries to influence the prices and output for particular products. Subsidies can be a specific amount of money per unit of good or service, or a percentage of price per unit. In some instances, subsidies can be paid based on the difference between a specified target price and a market price. Companies can receive subsidises on payroll or workforce or have their interest payments done on their behalf. Such payments are based on a formula determined by government as part of a deliberate economic or social policy.

Interest Payments

Interest payments are another classification of government expenditure. Governments borrow money from the public sector and from international creditors. Interest is the payment for the use of borrowed money. Governments pay interest on debt owed to individuals, businesses and foreign banks. Interest paid is on savings’ bonds, inflation protected securities and other securities. The funds obtained from loans are used to finance government activities especially investment spending. Governments are required to pay interest on debt in order to avoid default and to maintain confidence. In some countries interest payments are classified under current expenditure.

Capital Expenditure

Capital expenditure or fixed capital formation is spending on goods intended to create future benefits. This is spending on fixed assets such as land, equipment or intangible assets. Capital expenditure contributes to the overall national investment and stock of physical assets of the economy and is important for economic growth.

Lending

Lending is another classification of government spending. The national government can give loans to students or consumer loans to public employees as well emergency credit to public companies. Such government payments give rise to financial claims on others or to equity participation in the ownership of other companies. The difference between government payments and the receipts obtained from the sale of equities and loans repaid is called net lending.

Hidden Expenditures

Hidden lending is another classification of government expenditure. There are times when government expenditure is not explicit. Social security, subsidised lending, exchange rate subsidies and government loan guarantees are implicit expenditure that may fall under hidden expenditure. Also, regulations that may distort measures of public expenditure such as exchange rate controls may also fall under hidden expenditure. Tax expenditure is the most common hidden expenditure all over the world. Tax breaks on certain income levels or on expenditure on specific goods may also fall under the same classification of government expenditure. In some countries, governments may use tax deductions on mortgage interest to encourage home ownership and preferential tax treatment on pension savings. Tax expenditures are also costly for a nation since they can be applied to income taxes, value added tax and property tax. Their effects are likely to reduce inequality, promote economic growth and reduce economic distortions.

Government expenditure has been growing all over the world. This is because the activities of the government have been growing in order to promote economic growth. The continual growth in population especially in developing countries is a major factor in the increase in government expenditure. As such, this has forced the government to spend more on education and the health sector whilst supporting the food industry. In addition to the population growth there has been an increase in the number of people in their old age and this has also increased government expenditure on welfare old age pensions and unemployment benefits.