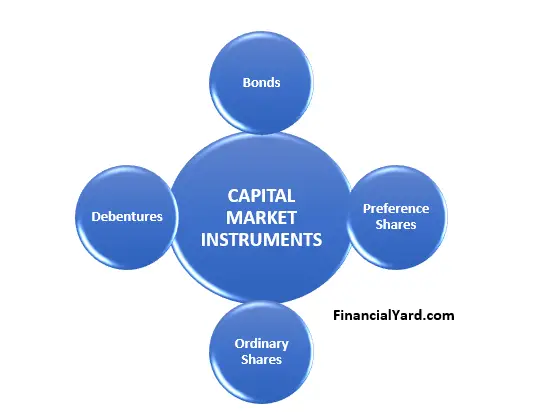

Capital market instruments typically consist of debt instruments and stock. The capital market is where governments and companies raise long term funds, normally 1 year or longer. There is a primary market, where new listings take place and a secondary market where existing securities trade. Some of the selected capital market instruments are Bonds, Debentures, Preference shares and Ordinary shares.

Table Of Contents

Bonds (Gilts)

This is an agreement, contract or guarantee between an issuer (the borrower) and an investor (the lender). The bond represents the borrower’s promise to pay interest along with the capital based on the specified terms. Bonds are one of the common capital market instruments.

Government Bonds

National governments issue bonds in order to raise capital for road construction, power stations and building hospitals. In most countries the government is regarded as the most creditworthy entity thus government bonds carry a low risk. In fact, government bonds are deemed risk free. The interest rate on governments bonds is deemed as a benchmark risk free rate on investments. That simply means it is the minimum return an investor should expect from a risk-free investment.

Corporate Bonds

Large firms issue bonds in order to raise funds for large capital projects.

Characteristics of Bonds

Principal amount: The amount the issuer agrees to repay at maturity, also known as the nominal, face value or redemption value.

Coupon rate: Normally a fixed rate, this is the rate of interest that the issuer agrees to pay to the bondholder. Zero coupon rate bonds pay no interest.

Term to Maturity: The number of years that will lapse until the principal amount can be redeemed.

Maturity date: The date that the issuer agrees to redeem the bond principal.

Required yield: This is the yield required to persuade investors to invest in the bond. This yield also reflects the current market yield for similar instruments.

Debentures

A debenture is a capital market instrument which is normally issued by companies in order to borrow money from investors. It is a fixed interest-bearing security. The principal amount is payable at a set future date. The term of maturity along with the interest rate is stated in the trust deed of the debenture. Debenture holders have a claim on a company’s revenue. In the event that a company fails to pay interest or capital, debenture holders will be paid off first when the company is liquidated. However, the risk of debentures is higher than that of government bonds.

Preference shares are another example of capital market instruments. Preference shares are issued at a fixed annual rate of dividend that means, investors receive fixed dividends as a reward for investing in preference shares. A company is liable for outstanding dividends unless the preference shares are non-cumulative.

Participating preference shares

- These have a fixed dividend and a share in the remaining profits based on a formula

Redeemable preference shares

- These shares are redeemed by the company in the future

- The redemption can be set on any date either set by the preference shareholder or by the company itself

- Redeemable preference shares have characteristics similar to that of debt, but dividends are paid out to investors instead of interest

Convertible preference shares

- These can be converted to a number of other financial instruments.

- They can be converted to debentures ordinary shares or even loans

- The shareholder or company can decide when to convert the preference shares

It is important to note that the risk of preference shares is higher than that of debentures. In the event of liquidation, preference share holders are paid off after debenture holders.

Equity shares are also an example of capital market instruments. These are shares that represent part ownership of a business enterprise. These shares are an interest in management, profits and assets of the company. Share certificates are proof of ownership but these days the share certificates are held by brokers in nominee accounts. Ordinary shareholders receive dividends after preference shareholders have been paid out. Ordinary shares also rank last in the event of liquidation. The return of ordinary shares are capital growth of the shares and dividend pay-outs. Ordinary shares are high risk investments with the level of risk specific to the particular company.

Differences Between Bonds And Equity

| BONDS | EQUITY |

| Guaranteed Income | Uncertain Income Stream |

| Limited Capital growth | Potential for capital growth |

| Have a term and a maturity date | Perpetuities Investment (no maturity date) |

| A more expensive way of raising Capital | A cheaper way of raising capital |

| Carry less risk than equity | Carry more risk than bonds |

The Investment Decision

There are various factors that need to be considered when an investor needs to make an investment in capital market instruments. These include the risks associated with each security and how risk averse the investor is. The term of the investment, the purpose of the investment and the obvious factor, the amount of money available for the investment. If a company or individual requires a steady flow of income, debentures or preference shares may be the ideal capital market instruments. However if a certain ordinary share is known to pay out dividends regularly it may also be considered among other capital market instruments.

As we have noted earlier ordinary shares carry more risk than bonds or preference shares. If a company or individual is less risk tolerant then bonds may be the suitable capital market instrument. If the investor is more risk tolerant then s/he may invest in preference shares or ordinary shares. The period of the investment should also be considered. If funds are available for 3 months, then money market instruments are a better option. That way, the return that can be obtained on the money market will be higher than will be obtained on the capital market. An investor can invest in capital market instruments and resell them but due to their long-term nature the return will be lower than the money market instrument’s return. If the funds are available for a longer period of time, the capital market instruments will be more ideal.

Key Words

RISK

The possibility that an investor might not receive his/her income and principal when it becomes due

LIQUIDATION

A situation where a company stops its operations and its assets are sold off to pay off its debt

PERPETUITIES

Periodic payments that begin on a certain date and continue indefinitely

MONEY MARKET

A market where short term debt instruments are issued and traded