There are different kinds of financial institutions with each offering specific offerings to serve corporations and the general public. These institutions include commercial banks, investment banks and merchant banks. A merchant bank facilitates trade and its services are limited to corporates, high net worth individuals and small to medium enterprises. The services of merchant banks also apply to international trade. In some countries the functions of merchant banks and investment banks are similar although these financial institutions are different. Merchant banks focus on trade and the exchange of goods and services. The role of merchant banks in developing the financial market has been significant. This article outlines the functions of merchant banking.

Table Of Contents

3 types of Merchant Banks

- Full Service: These cater to small businesses or retail customers together with large organisations and multinational companies.

- Regional: These banks cater to small and medium enterprises

- Boutique: These specialise in retail banking and cater to the needs of small businesses

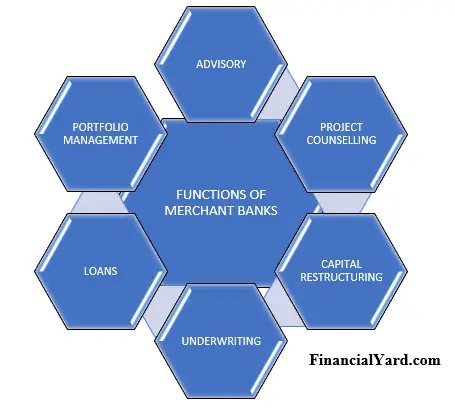

Some of the functions and roles of merchant banks are as follows;

Advisory Function

Advisory is a major function of merchant banks. Merchant bankers give advice to corporate enterprises. They can assist in deciding a profitable product line based on market research. This includes guiding corporate units with regards to diversification, expanding or discontinuing a product line. Merchant banks also function to offer advice to start-up companies and firms that want to expand.

Project Counselling Function

By studying various company projects, merchant bankers advise on a project’s viability and development. They also prepare project reports that take into account the financial and economic feasibility of each project as well as the costs involved. Merchant bankers also provide assistance in obtaining a government’s approval for project implementation. Project counselling is an essential function of merchant banking.

Capital Restructuring Services

One of the important functions of merchant banking is to offer different capital restructuring services to corporate units. They do this by examining the capital structure of a corporate unit in order to decide the extent of capitalisation and alternative capital structures. Merchant bankers can advise companies on disinvestments that may work in the company’s favour. In order to ensure that they are not incurring any losses, merchant banks asses a company’s financial statements in addition to other kinds of services that have to do with liquidation of assets. They also track the income made by these companies to find ways to generate more revenue. This is an essential role of merchant banks.

Underwriting Function

Underwriting is a major function of merchant banks. Large firms often use the services of a merchant bank in obtaining capital. By evaluating the amount of stock to be issued together with the value of a business and the timing of the new issue, merchant banks assist in equity underwriting. The handling of all the necessary paperwork is done by the merchant bank regarding new issues. Some merchant banks guarantee a specific rate or price for securities by being prepared to take up all or unsold new issues. They also quote the bidding and offer price for the financial securities, by so doing making the market in debt and share issues. Underwriting is one of the core functions of merchant banking.

Loans

Issuing loans is also a function of merchant banking. Merchant Banks can be regarded as a foundation for small to medium enterprises in terms of their finances since they can provide business loans for start-up companies. These banks decide how much money a new firm can be given based on the start – up’s project proposal. Merchant banks can also assist companies in raising funds through the stock exchange and other activities. Credit syndication is also another function of merchant banks which assist corporates. They process loan applications for both short- term and long-term credit from various other financial institutions. Total costs are estimated and a financial plan for the client is developed. Some can even go as far as choosing the right financial institution to provide credit facilities and to ensure the lender’s willingness to participate and engage in legal formalities regarding the loan. This function of merchant banking is important to small and medium enterprises.

Portfolio Management

Portfolio management is an important role of merchant banking. In order to enhance the value of the underlying investment, merchant banks provide portfolio management services. They do this by advising their clients with regards to investment decisions and this includes suggestions for an investment mix. Other merchant banks take the role of buying and selling securities for their clients in addition to managing retirement and mutual funds so that their clients reach their investment goal.

Other Roles and Functions of Merchant Banking

- Raising Finance

- Corporate Counselling

- Project Management

- Capital Restructuring Services

- Act as Stock Exchange Broker

- Portfolio Management

- Offers advise on expansion and modernisation

- Issuing Loans

- Money Market Operations

- Leasing Services

- Offering working capital finance

- Bill Discounting

- Offering venture capital

- Underwriting

- Advisory services

Differences between Merchant banks and Investment banks

There is a thin line between merchant banks and investment banks. As indicated earlier, in some countries merchant banks and Investment banks perform the same functions. Also, the word ‘merchant bank’ is an old English word for ‘Investment bank’. However, these 2 institutions are different with functions that differ in several ways. In some countries merchant banks serve small scale companies that are too small for large investors. Creative credit products such as bridge financing, equity financing and mezzanine financing are offered to these small companies. They may even take ownership of the promising ones. On the other hand, Investment banks focus mainly on underwriting through Initial public offerings and share offerings. The major clients investment banks serve are large companies with enough funds to finance the sell of securities to the public. Investment banks can also advise their clients on mergers and acquisitions, buyouts as well as capital restructuring. It is important to note that the functions of merchant banks and investment banks differ from one country to another.

Some Notable differences between functions of merchant banking and investment banking

| MERCHANT BANKS | INVESTMENT BANKS |

| Provide loans | Create Capital for Companies |

| Facilitate trade and offers financial services | Offers financial services |

| Does not offer Merger and Acquisitions services | Facilitates Mergers and Acquisitions |

| Serves corporate firms | Serves Corporate firms and the general public |

| Management oriented | Assets oriented |

| Assist in issuing shares through private placement | Underwrites and sell shares through initial public offering to the public |

Key Words

INITIAL PUBLIC OFFERING

When the stock of a company is offered for the first time to the public on the stock exchange

UNDERWRITING

The process where an individual takes on financial risk for a fee. Underwriters buy securities from issuing companies and resell them to the public.

PORTFOLIO

A collection of financial assets such as bonds, stock, commodities and cash equivalents held by a firm or an individual

MERGERS AND ACQUISITIONS

Refers to the consolidation of companies where, a merger is a combination of 2 companies to form one entity and an acquisition is when one company takes over another company