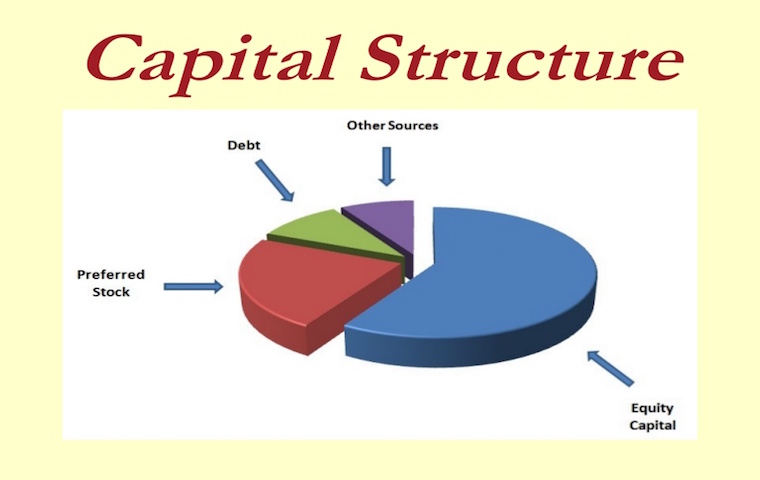

An important consideration of any business is the capital structure and funding. It is important because it affects matters of cost of capital, internal rate of return, liquidity and internal growth rate. It is not a simple of electing to largely finance via debt or equity. There many determinants of the capital structure that a business uses which include expected growth rate, cost of capital, risk, cash flow, control, flexibility, inflation, legal considerations and timing among others. Capital structure while split between debt or equity can get complex as equity instruments such as preference shares have all the characteristics of debt and therefore are considered debt in the balance sheet.

Table Of Contents

Nature And Size Of a Firm

The first capital structure determinant we should look at is the nature and size of the business. Larger businesses which meet requirements can list and access equity from the public through listing their shares. The same is not available to smaller businesses which can incorporate but would access equity through private investors. Size also affects the ability of a business to attract long term debt financing. Large companies can access debt through securities such as preference shares, these are equity holdings which command a fixed interest percentage like debt. Smaller businesses may have to apply for commercial debt or borrow privately from individuals.

Risk

Risk is a broad term as many factors can determine how risky a business is. Risk comes into play as it has a direct bearing on the cost capital. It is perhaps the most important capital structure determinant because investors or lenders will genera;l expect a higher return for accepting greater risk. So interest rates on the debt would be higher while the expected rate of return on equity would be higher. The risk may be so high that some capital raising options are not available to the business.

Cost of Capital

Risk is however not the only factor in the cost of capital. Depending on economic conditions the cost of capital can be considered either high or low for a particular business. This determinant of capital structure is completely external to the business but very important. This cost has to be considered by the business because the investors or lenders would expect this return to be met. Finding capital at a cost that is within the reach of the business is very important.

Financial Leverage

Lenders are concerned primarily with the ability of a borrower meeting interest payments. These payments are mandatory. Leverage refers to the degree to which a business or entity uses borrowed money as funding capital. The more of its capital that is borrowed the greater the mandatory interest payments that it must make. Therefore as a rule of thumb lenders would prefer borrowers with lower leverage. This capital structure determinant may restrict access to both equity and debt capital.

Control

Another important capital structure determinant is control of the business. Inviting new equity holders to the business means the additional equity holders will also have a say in business decisions. In some cases this is not desirable, business owners would like to maintain control of the business and this makes debt financing more attractive. There is, of course, a trade-off with debts impact on the leverage position of the company and the mandatory interest payments. The decision will depend on what is more important to business owners.

Cash Flow

In the previous determinant of capital structure, we saw how some business owners may be willing to take on mandatory interest payments rather than sharing control in the business. One of the circumstances in which this can happen is when the business is generating very high cash flows and can easily afford interest payments. The other side of this is when a business is generating low cash flows and lenders would not be willing to lend on the grounds of liquidity concerns.

Inflation

In times of high inflation, the value of money reduces as time goes. In a mere matter of months or weeks, an amount that seemed large may be small given that the business keeps raising prices of its products to match or beat inflation. However, if the business owners enter into an agreement that provides to the finance to the business with fixed repayment amount you will find as time goes by the repayments become very small. Inflation is, therefore, a determinant of capital structure. It also has an impact on expected rates of return for equity holders as they would expect returns that beat inflation.

Requirement of Investors

Another determinant of capital structure may be the requirements of investors. Investors analysing business based on their stage and can divide businesses into various types including start-up, growth and mature businesses. Investors are usually happy to see earnings being retained in start-up and growth companies but would prefer regular dividends in matured companies.

Growth And Stability Of Sales

In capital structure determinants inflation and cash flow we explained that businesses with large or increasing cash flows. One factor that can play a role in this is the level of sales. Whether sales are growing or stable also determines capital structure choice. Stable sales would indicate flattening revenue and therefore cash flow. A business with constantly growing sales, however, indicates increasing revenue and therefore cash flows. They may be more open to debt financing. One caveat though is that businesses with high cash flow may be better placed reinvesting profits to fund growth internally.

Flotation Costs

Flotation is the process of offering shares to the market publicly. There are costs associated with floating shares publicly including underwriting costs, publication and others which must be paid by a company to float shares publicly. This is, therefore, a capital structure determinant as well because costs may prove prohibitive in certain circumstances.

What is important to note about capital structure determinants is that they are not mutually exclusive. A business may face multiple determinants of capital structure when they are making the decision. These come together to make capital structure decisions extremely complicated affair.